How has value-added services changed the face of protection?

In a relatively short 10 years, extra services such as medical opinions, services, support, and advice have gone from an added extra, to an integral part of many policies.

In its early stages, added benefits took the form of additional medical support for those suffering from a critical illness. One of the most popular has been the use of a company called “Best Doctors“ who can check a medical diagnosis (or provide one) in order that you are able to make the best treatment decisions.

Often a provider will combine support services from various organisations, for example AIG Life not only give access to Best Doctors but also bereavement and counselling services from Winstons Wish. This has proven to be an extremely valuable combination for their customers and their children.

But now, extra services and added benefits to policies are front and center of cover, including life and income protection, which is great news for customers.

These added services provide much-needed peace of mind. It also provides more cover during and after the life of the policy, expanding beyond the final financial support we have come to expect.

This can include medical opinions on diagnosis, or bereavement counselling after the passing of a loved one. Even with income protection, added services can help claimants in getting back to work quickly with the right support and guidance.

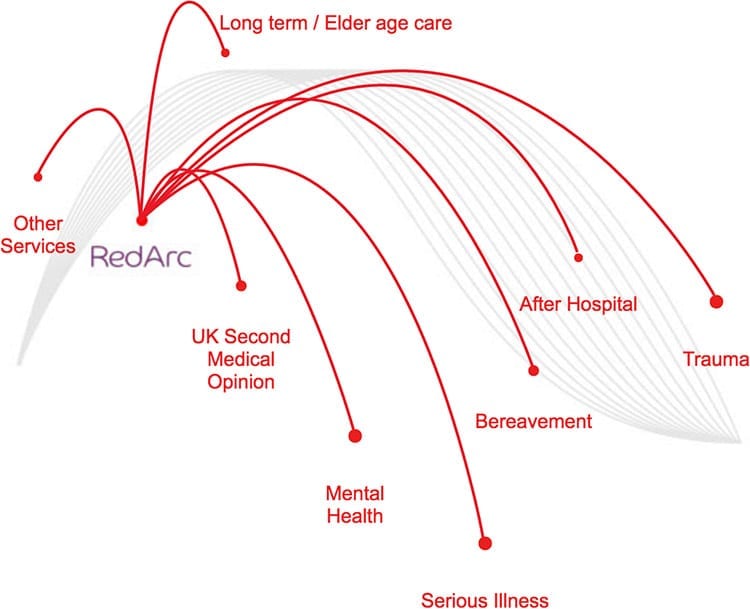

Some providers like Royal London, Scottish Widows, Aviva, Guardian and One Family go even further, using a company called RedArc they provide the support of a dedicated nurse. They’ll provide tailored support whenever it’s required, with no time limit for how long they will help you.

If you are unlucky enough to be diagnosed with a serious illness like cancer, or multiple sclerosis the nurse can help you to understand the condition; providing assistance with the best way to manage both the condition itself and the side effects of treatments.

Depending on the type of illness or injury, the dedicated nurse can recommend a number of additional services if they think it’s going to help. For example:

- a second medical opinion

- support recovering from a heart attack

- speech and language therapy after a stroke

- complementary therapies to help manage symptoms or help with recovery

More importantly, these services help advisers talk to clients about protection. By understanding why these benefits are so valuable to others, it can be easier to see the importance of cover and its value to you long term.

Many of these services are now available even with basic Life Insurance policies at low prices, for an instant online quote click on the link below.

Or call 0800 024 8685 to diccuss the best type of plan to support you and your family.